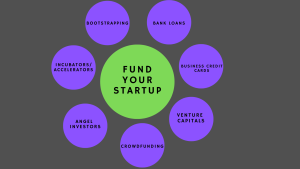

Getting Funds For Your Startup-Where To Look?

No matter how out-of-the-world your business idea is, locking the needed capital to launch and expand the startup is crucial to startup success. In their first year of operation, startups fail at over 94%. One of the most frequent causes appears to be a lack of money. A startup runs on money like life does on blood.

There are other ways than using one’s own money or borrowing from friends and family when starting a new business. However, company entrepreneurs must know that securing finance is never straightforward and frequently takes longer than expected.

This article will discuss the important ways to get your business startup capital.

Bootstrapping

Bootstrapping, or self-funding, is a triumphant method of startup financing, especially when your company is just starting off. First-time entrepreneurs frequently struggle to secure finance without demonstrating some traction and a strategy for feasible success. You can put money from your savings or contributions from family and friends toward an investment. This will be easier to raise due to lesser needs and procedures, besides lower expenses. Family and friends are typically lenient when it comes to the interest rate.

Due to its benefits, self-financing or bootstrapping should be considered a first funding alternative. You are bound to do business when you have your own money. Nevertheless, this is only appropriate if the initial requirement is modest.

Bank Loans

When seeking capital, entrepreneurs usually turn to banks as the first step.

The bank offers two types of funding for startups. The two loans offered are operating capital and finance. The loan amount needed for one complete cycle of revenue-generating procedures is known as working capital, and hypothecating debtors and stock often determines it. When receiving funding from a bank, You would normally disclose the business plan, valuation information, and project report upon which the loan is sanctioned.

Avail of Business Credit Cards for your Startup

Many credit card companies offer special incentives to the small business sector, such as cash-back rewards, airline miles points, and other perks.

Some issuers demand that the card be connected to the owner’s credit score, credit history, and ownership guarantee. Naturally, any defaults or late payments on the company credit card would impact your credit score.

You can apply for a small company credit card online or through your bank. Using the card won’t affect your credit score because a new wave of credit card issuers targeting the small business industry does not demand personal guarantees.

Crowdfund your Startup

Crowdsourcing is the activity of soliciting money from a variety of sources, frequently using well-known crowdfunding platforms.

Crowdfunding allows new business owners to secure seed money for their ventures and can support product or service promotion efforts. You can easily set up an effective crowdfunding campaign. You create a profile on a crowdfunding website and include information about your business, how much money you’re attempting to raise, and your firm. People interested in your cause can contribute to your campaign in exchange for a reward or some equity or profit-sharing in your company.

A captivating narrative about your company, product, or service and a worthwhile donation incentive is essential to successful crowdfunding campaigns. Since you are only donating a portion of your products or services or a discount on them, rewards-based crowdfunding is a desirable choice for startups. You are not giving away equity or part ownership in your business. A crowdfunding campaign can be used to create a community of supporters for your business or products and gives donors a sense of involvement.

Venture Capital

Startups in need of funding frequently turn to venture capital (VC) companies. These companies can offer various services, including funding, strategic advice, introductions to possible clients, partners, personnel, and more.

Financing for venture capital is difficult to come by. Typically, venture investors invest in firms seeking extensive, rapidly growing opportunities that have already gained some traction.

You should be aware that venture capitalists frequently concentrate their investment efforts using one or more of the following standards: specific sectors of industry, Stage of the Company and Location. A warm introduction from one of their dependable colleagues or another professional contact of the VC, such as a lawyer or a fellow entrepreneur, is the ideal method to get their interest. To pique a VC’s attention, a firm has to have a solid investor pitch deck and an effective “elevator pitch.”

Find Angel Investors for Your Startup

Angel investors often invest in early-stage or startup businesses for a share of the company’s equity. Additionally, they screen the proposals before investing as a group in networks. In addition to funding, they can provide mentoring or counsel.

Angel investors are primarily concerned with the founders’ calibre, commitment, and honesty, the market gap being addressed, and the potential for the business to grow to be very large. Another thing that attracts angel investors is a well-thought-out business plan and any early signs of progress toward the goal. They are also very concerned about the potential of raising subsequent rounds of startup funding if success is made, an appropriate value with reasonable terms, and exciting technology or intellectual property.

A strong introduction from a friend or coworker of an angel investor is the best way to find an angel investor. Find out what relationships you may already have using LinkedIn. It frequently helps to start with your connections in that field because angel investors are considerably more inclined to invest if they are familiar with your industry. Other ways to attract angel investors include lawyers and accountants, AngelList, angel investor networks, venture capitalists and investment bankers, and crowdfunding websites like Kickstarter and Indiegogo.

Incubators/ Accelerators for your Startup

Programs like incubators and accelerators can be a source of investment for startups. These initiatives, found in almost every large city, support hundreds of new enterprises annually.

Although the two names are often used interchangeably, there are just a few key distinctions between them. Incubators are like a parent to a child, nurturing the business by giving it a home, resources, training, and connections. Accelerators do much the same thing as incubators, except an incubator helps a firm learn to walk while an accelerator encourages it to run or take a significant jump.

The business owners participating in these programmes must invest a significant portion of their time since they usually last 4 to 8 months. This platform allows you to network with mentors, investors, and other businesses in your field.

Be clear about your relationship goals before reaching out to possible startup sharks.

Perhaps you would want someone to guide you through the initial stages of setting up a business. If yes, venture capitalists, angel investors, or private equity firms are better suited to finance your startup. If getting money is your only objective, crowdsourcing or microloans are better options.

Your startup idea may come to reality if you know how to identify the ideal investor for your company.

-

14

+Category

-

98

+Post

Top Categories

Popular Posts

- The Power of Prototyping in Software Development

- Version Control Best Practices for App Development

- Understanding Visual Hierarchy: A Guide to Effective Design

- Crafting Intuitive Navigation: A Guide to Seamless User Experience

- Choose Your Best Cloud Provider

- Making the Leap: Transitioning from Manual to Automated Software Testing

- Using GitHub- Advantages and Disadvantages

- E-commerce Product Photography on a Budget

- Tech Innovation in Developing Countries

- Smart Cities: How Technology is Shaping the Urban Landscape

- Principles of Composition: Creating Visual Harmony with Composition

- Exploring Cross-Platform App Development

- Why Regular Website Updates Matter

- Navigating Effective Facebook Audience Targeting

- Implementing Ads for Game Monetization

- Designing User-Centric Mental Health Apps: Enhancing Well-being in the Digital Age

- NFTs and Collectibles: Creating NFT App Solutions for Collectors and Enthusiasts

- Successful Implementation of Enterprise Apps

- Maximizing Business Impact with EQ

- Proven SMO Ads Optimization Tips (2023)